The financial world recently witnessed a significant move in the infrastructure sector with the announcement of a merger between BlackRock, the world’s largest asset manager, and Global Infrastructure Partners (GIP), a leading independent infrastructure investor. This strategic union could potentially reshape the competitive landscape, as both entities bring considerable resources and expertise to the table. Together, they position themselves to capitalize on growing global demands for infrastructure investment, fueled by economic growth and an emphasis on sustainable development.

This merger signals a possibly transformative trend within the private equity space, as firms increasingly seek to create scale and diversification in their portfolios. BlackRock and GIP combining forces is indicative of a larger shift towards consolidation within the industry, as companies aim to better compete for large and complex infrastructure projects worldwide. Such consolidation can offer private equity firms like BlackRock enhanced deal-sourcing capabilities, greater operational efficiencies, and an improved ability to raise substantial funds.

Industry observers are pondering whether this merger could trigger an ‘infrastructure arms race’ among private equity firms. The prevailing view is that as the infrastructure investment market matures, the competition to acquire and manage these assets will intensify. As a result, firms are seeking to amass the financial firepower and domain knowledge necessary to lead in a sector that is becoming increasingly critical to global development and economic stability.

Assessing the Merger Impact

The BlackRock-GIP merger has significant implications for the investment and infrastructure sectors. It reshapes the trajectory of private equity’s role in infrastructure investment.

Investment Landscape Shift

The investment landscape for infrastructure is undergoing a transformation due to the acquisition between BlackRock and Global Infrastructure Partners (GIP). The combined entity now controls an extensive pool of capital for infrastructure projects. The assets under management (AUM) post-merger have increased substantially, enabling the deployment of funds across various sectors, from transportation to energy. This infusion of capital is likely to spur growth in the number and scale of infrastructure projects.

- Pre-merger AUM: x billion USD

- Post-merger AUM: y billion USD

- Expected growth: z%

Private Equity Influence Expansion

Private equity firms, traditionally known for high-yield investments, are expanding their influence by acquiring larger stakes in infrastructure assets. BlackRock and GIP’s merger illustrates this shift, with both firms positioned to dominate the market. The merger enables broader and deeper penetration into global infrastructure markets, aligning with long-term investment strategies that crave stable cash flows and diversification. This strategic reallocation of private equity funds into infrastructure denotes a marked preference for asset-backed investments in a sector known for resilience to economic fluctuation.

- Key markets targeted:

- Transportation

- Renewable Energy

- Utilities

- Competitive advantages post-merger:

- Enhanced deal-sourcing capacity

- Diversified investment portfolio

- Stabilized revenue streams

Strategic Advantages and Synergies

The merger between BlackRock and Global Infrastructure Partners (GIP) creates a synergistic relationship that leverages both firms’ strengths in infrastructure investment. The alliance is set to provide clear strategic advantages by pooling resources and expertise.

Consolidation of Expertise

The combination of BlackRock’s and GIP’s capabilities means a consolidation of substantial expertise in energy, digital infrastructure, and transport. This merger has established a platform with market-leading professionals who bring a holistic approach to infrastructure expertise. The unified team’s operational improvements could now stretch across a wider range of assets, including pivotal sectors like airports.

- Energy: Expertise in both traditional and renewable energy investments.

- Digital Infrastructure: Knowledge in the growth area of digital needs.

- Transport: Insights into the operations and investments in transport infrastructure.

Enhanced Investment Opportunities

The merger brings about enhanced investment opportunities by creating a substantial scale that enables larger and more varied investments. This encompasses co-investment opportunities and differentiated origination, particularly in sourcing investment opportunities.

- Investment Opportunities: Access to a broader spectrum of potential investments.

- Co-Investment Opportunities: Ability for investors to engage in larger-scale projects.

- Differentiated Origination: Unique approach in identifying and securing investments.

Joining forces, BlackRock and GIP are equipped with a wider range of investment talent and capabilities, which positions them to capitalize on synergies within the infrastructure sector effectively.

Financial and Market Implications

This section addresses the financial effects and stockholder viewpoints related to the BlackRock-GIP merger, offering insights into the shift in revenue dynamics and stock market reactions.

Impact on Revenue and Performance

The merger between BlackRock, an asset manager, and Global Infrastructure Partners (GIP) is projected to significantly influence both entities’ revenue streams and performance metrics. BlackRock’s cash reserves and asset management competencies are expected to combine with GIP’s infrastructure expertise to potentially create new revenue synergies. These synergies could arise from expanded offerings and an enhanced customer base. Performance is likely to be affected in terms of both margin affection and returns on investment, given that infrastructure investments can yield steady cash flows over long periods, which can stabilize asset managers’ performance against market volatility.

Stock Market and Shareholder Perspective

From a stock market perspective, the announcement of the merger could lead to fluctuations in the price of BlackRock common stock, influenced by investor sentiment regarding the strategic benefits of the deal. Shareholders will closely monitor the impact of the merger on stock performance, including any changes in dividend payouts or share valuations. Furthermore, if the merger involves an exchange of BlackRock shares for those of GIP, shareholders will be looking at the cash consideration side of the deal and how it impacts the equity value. The use of cash, debt, or stock as the medium of exchange in the transaction will also be scrutinized for their effects on the financial leverage and liquidity of the new entity.

Looking Ahead: The Infrastructure Sector’s Future

The BlackRock-GIP merger is poised to reshape the infrastructure sector, signaling shifts in investment strategies and highlighting the critical role of infrastructure in economies worldwide.

Trends in Global Infrastructure Investing

Market Dynamics: Infrastructural development is gravitating towards sustainability and modernization, with a keen focus on decarbonization and digital prowess. Renewable energy projects, alongside water and waste management, are gaining traction as governments and private equity groups recognize the urgent need for energy security and sustainable growth.

- Infrastructure Assets: Traditional assets like the Port of Melbourne and Sydney Airport are now part of comprehensive portfolios that prioritize long-term, stable returns.

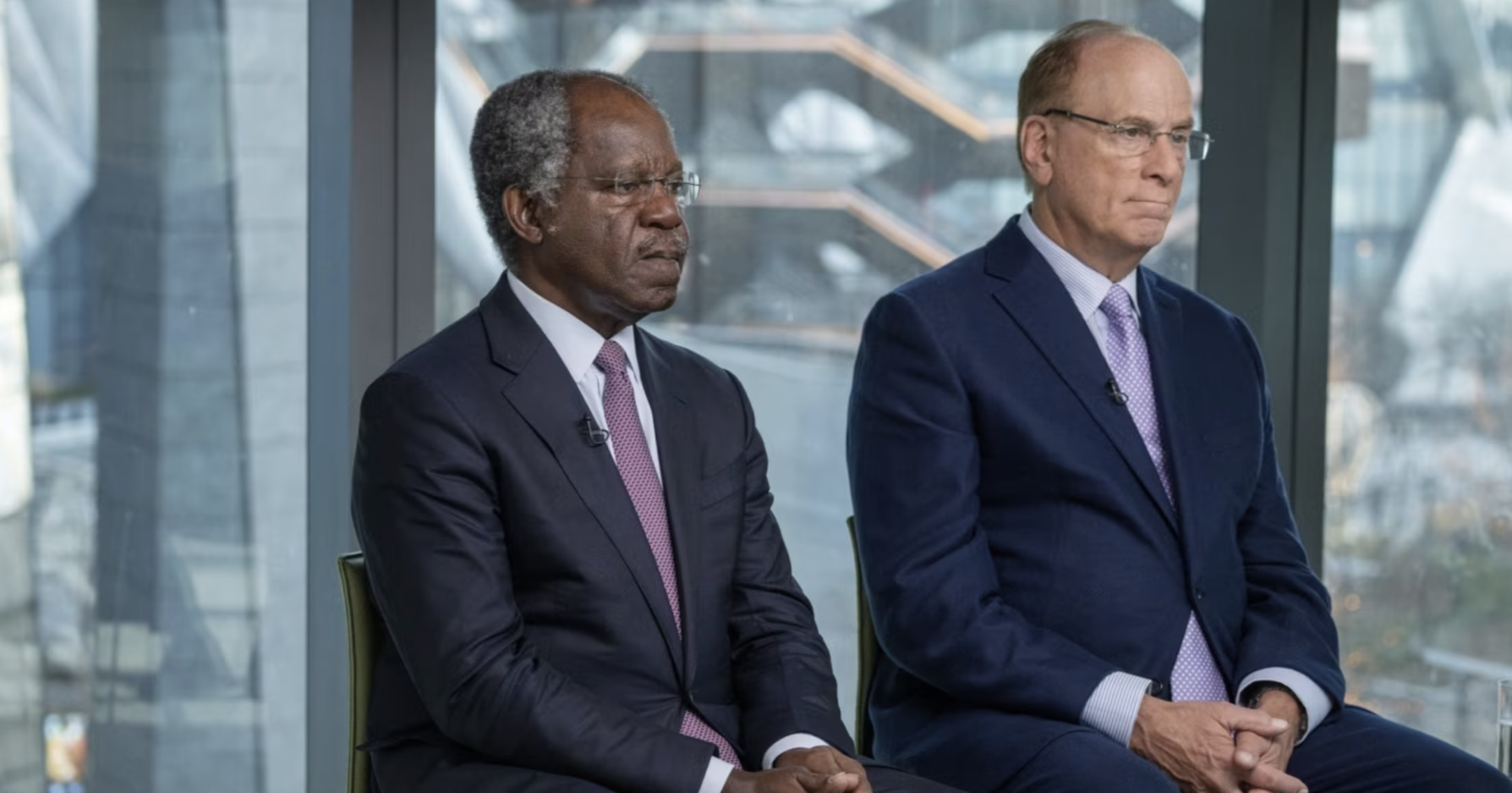

- Investment Leaders: Power players such as BlackRock’s CEO Larry Fink and GIP Chairman Bayo Ogunlesi are guiding their firms to invest in assets that support a low-carbon economy.

Growth Influence: Investments are increasingly directed at enhancing digital infrastructure, ensuring that access to high-speed internet and cloud services propels economic development.

Implications for Energy and Digital Growth

Energy Perspective: The surge in structure investments by firms like BlackRock and GIP underscores the push towards renewable energy sources, aiming to meet global decarbonization targets.

- Asset Integration: The merging of large infrastructure funds and managers can potentially streamline projects, fostering advancements in both renewable energy and traditional sectors like transport.

Digital Expansion: Digital infrastructure has become an integral aspect of global investment portfolios, with the proliferation of data centers and connectivity networks reflecting a broader commitment to digital growth.

- Government Cooperation: To accelerate this expansion, infrastructure managers are collaborating with governments to optimize investment frameworks and policies.

In essence, the integration of environmental goals into infrastructure investment is leading to a new era where private equity groups, armed with extensive capital and management expertise, are not just participants but are becoming leaders in shaping a sustainable and digital-forward future.